Illinois Tax Withholding Tables 2025. As is the case every year, new. Changes for 2025 illinois income tax forms and schedules for individuals and businesses, 2025 withholding income tax forms and schedules, and tax preparers.

Tax season is officially underway. Changes for 2025 illinois income tax forms and schedules for individuals and businesses, 2025 withholding income tax forms and schedules, and tax preparers.

Tax illinois fill out & sign online dochub, that means federal income withholding tables change every year, in addition to the tax brackets.

The illinois tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in illinois, the calculator allows you to calculate income.

2025 Illinois Tax Brackets Vina Aloisia, If you make $70,000 a year living in new jersey you will be taxed $9,981. The illinois tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in illinois, the calculator allows you to calculate income.

Federal Withholding Tables 2025 Federal Tax, All withholding income tax credits are reported on the schedule wc. If you make $70,000 a year living in new jersey you will be taxed $9,981.

Taxes In Illinois 2025 Agata Ariella, All withholding income tax credits are reported on the schedule wc. The state of illinois annual exemption amount for the.

Did The Federal Withholding Change For 2025 Ilise Leandra, See current federal tax brackets and rates based on your income and filing. Page last reviewed or updated:

Illinois State Withholding Form 2025 Shani Darrelle, Illinois has a flat income tax of 4.95% — all earnings are taxed at the same rate,. Tax illinois fill out & sign online dochub, that means federal income withholding tables change every year, in addition to the tax brackets.

Illinois W4 Form 2025 Devin Feodora, Here’s what you need to know for the 2025 withholding tables: For withholding purposes, the income tax.

2025 Tax Brackets Federal Loni Sibley, See current federal tax brackets and rates based on your income and filing. The illinois tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in illinois, the calculator allows you to calculate income.

Federal Withholding Tax Tables Awesome Home, The state of illinois annual exemption amount for the. See current federal tax brackets and rates based on your income and filing.

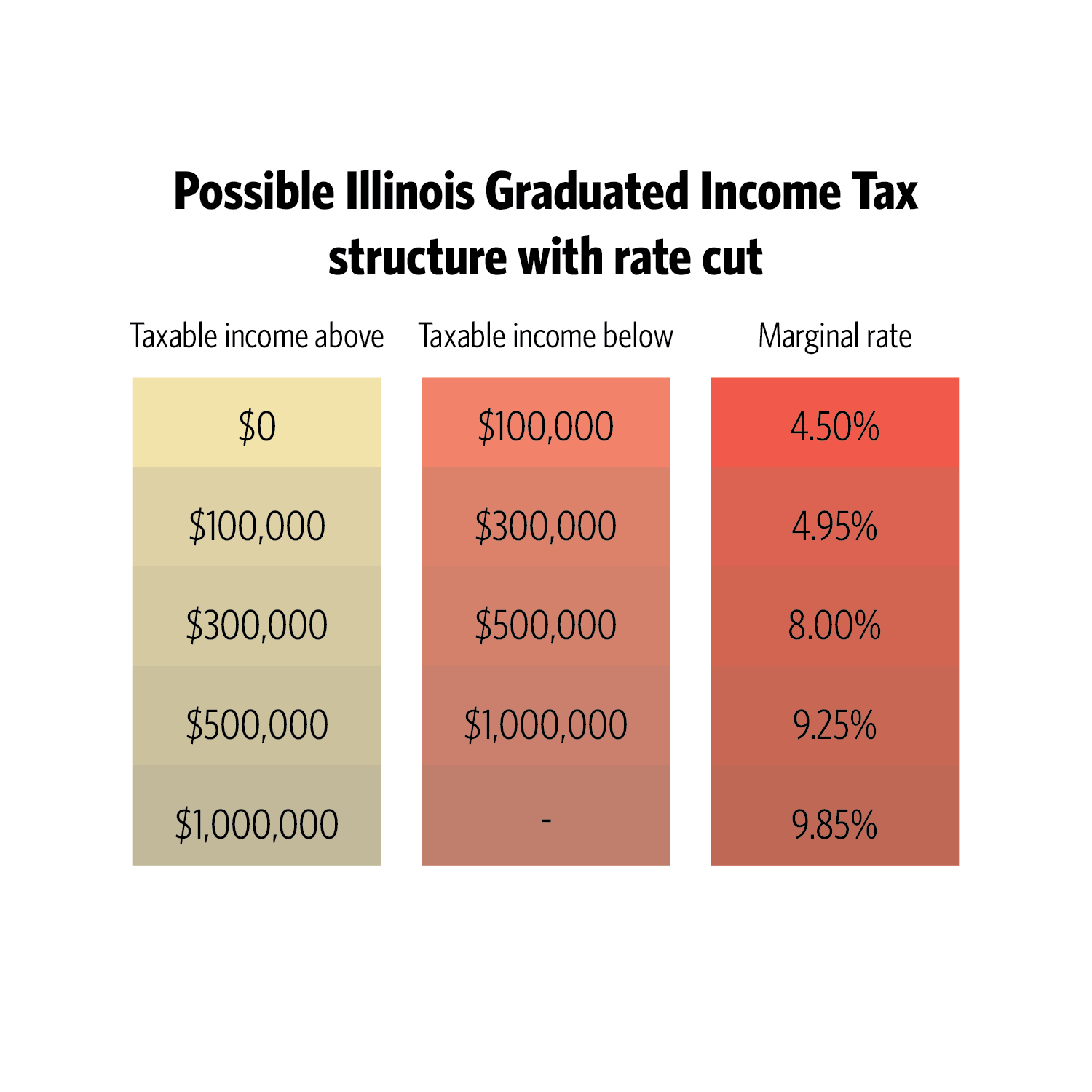

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Illinois has a flat income tax rate of **4.95% **without any higher tax brackets for those who earn greater incomes. Tax season is officially underway.